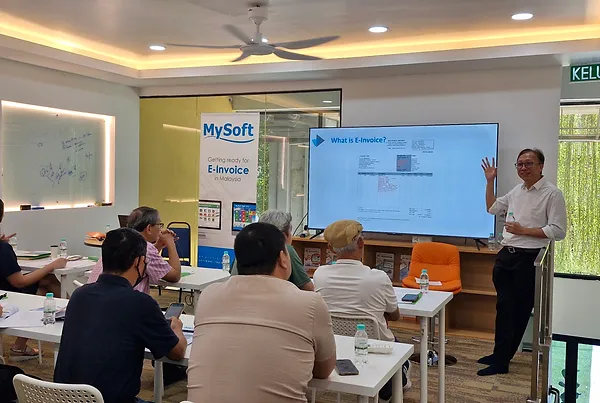

Streamline Your E-Invoicing: Achieve LHDN Compliance with Ease

Quickbill is proud to present a sophisticated e-Invoicing solution designed for Malaysian businesses. Developed with expert insights and thorough research, this platform integrates seamlessly with existing systems while ensuring a user-friendly experience. Compliant with Inland Revenue Board regulations, Quickbill represents the premier choice for e-invoicing, reflecting our commitment to advancing business through innovative technology.

When Should You Begin E-Invoicing?

Implementation will commence gradually, beginning in August 2024 as outlined below:

1 August 2024

For businesses with an annual turnover of RM100 million or more

1 January 2025

Businesses with an annual turnover of RM25 million to RM100 million

1 July 2025

E-Invoice becomes mandatory for all taxpayers in Malaysia

However, businesses can voluntarily register E-Invoice from

1 January 2024

Are you encountering similar challenges in preparing for E-Invoicing?

Rest assured, we've got you covered!

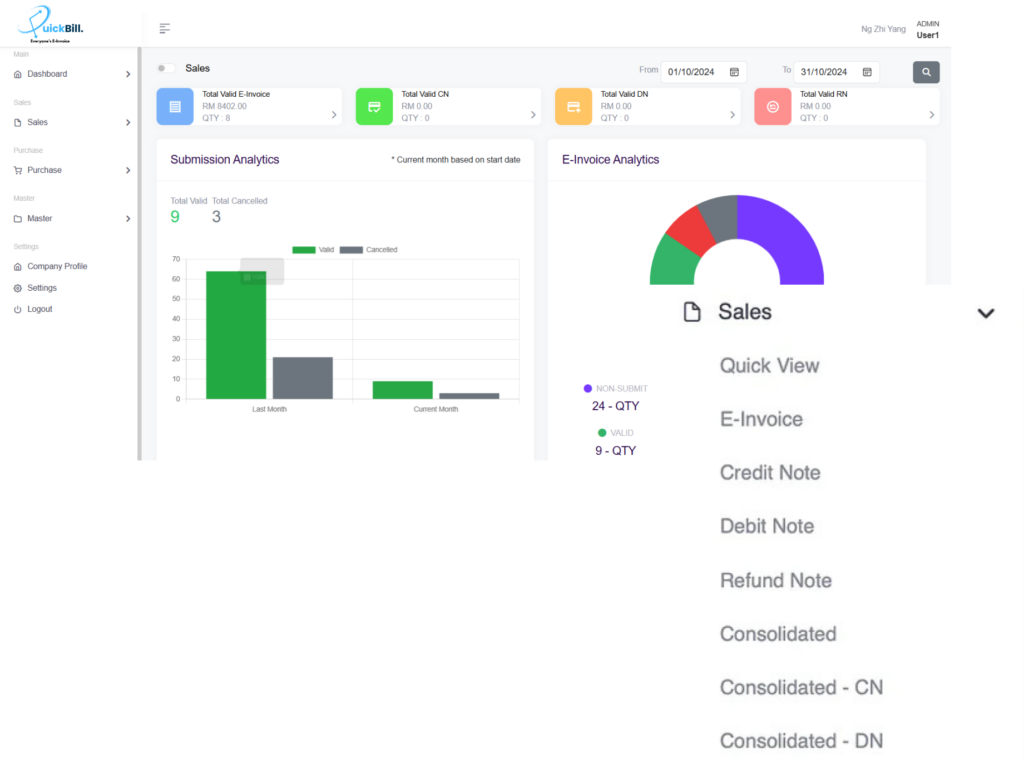

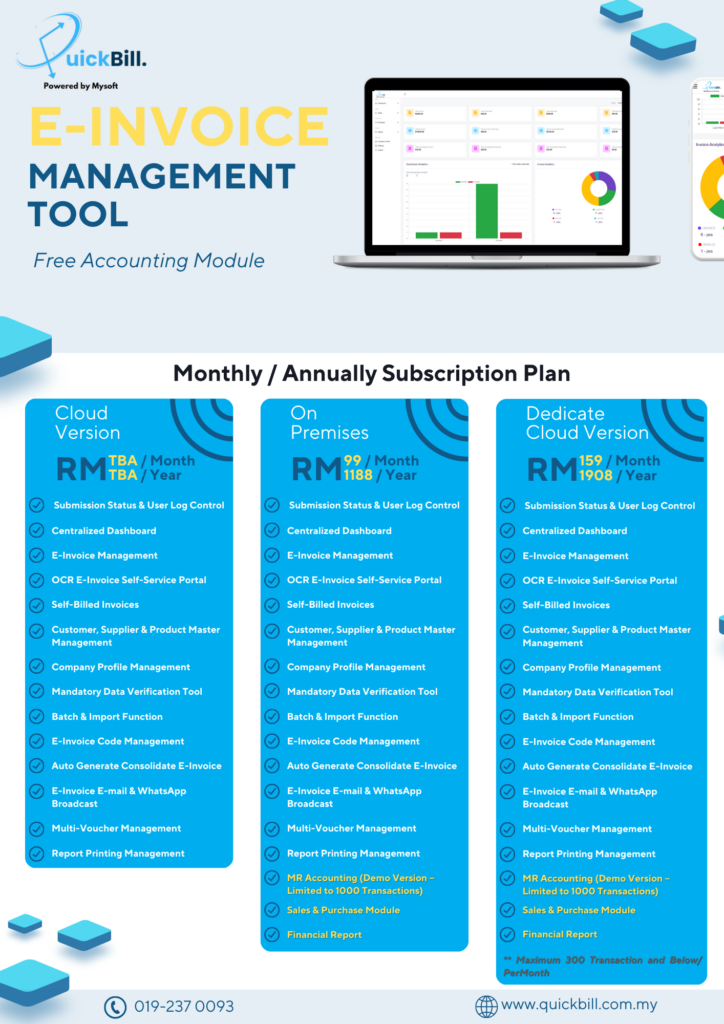

Discover our E-Invoice Management Tools solution features

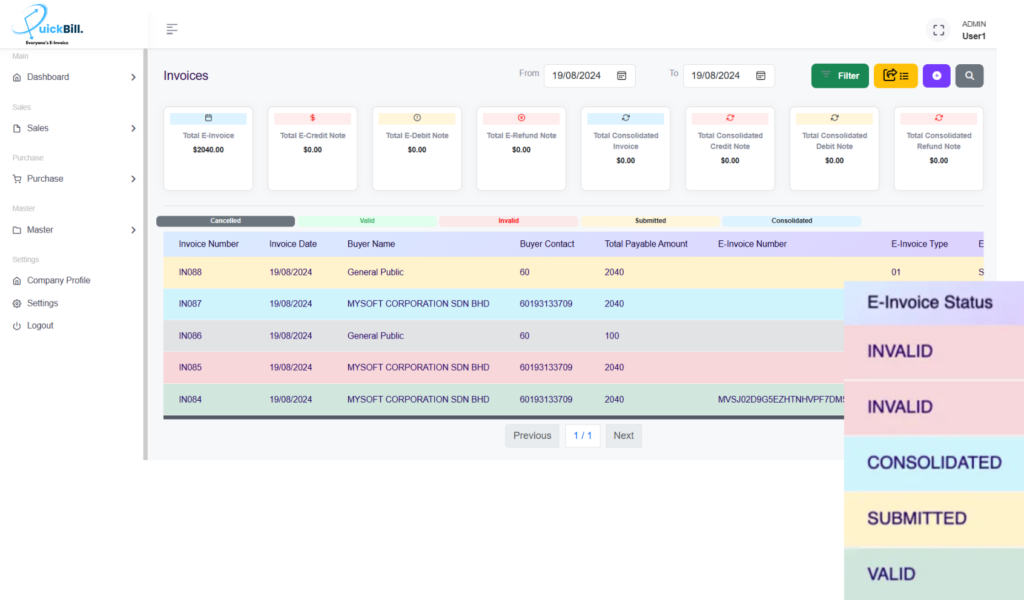

Handle All Kind of E-Invoices Type

E-Invoice, credit note, debit note, refund note, consolidated e-invoice and self-billed e-invoice all in one place.

Track Your Invoices More Effectively

Keep your invoices organized and accessible.

© 1998 - 2024 by MySoft Borneo Sdn Bhd, The ERP Studio PLT & The E Invoice Studio PLT. All Rights Reserved.